Market Analysis Review

NZD Up, USD Down in inconsistent Trading; U of M survey

Rates as of 05:00 GMT

Market Recap

I have to admit, as an American citizen, I’m more interested in what went on in the US overnight than I am in the FX market this morning. It’s incredible to see a former US president accused of making off with top-level nuclear secrets.

What’s even more amazing is to see other politicians of his party supporting this person and not defending the country that they allegedly work for. This is the stuff of Netflix dramas, not real life.

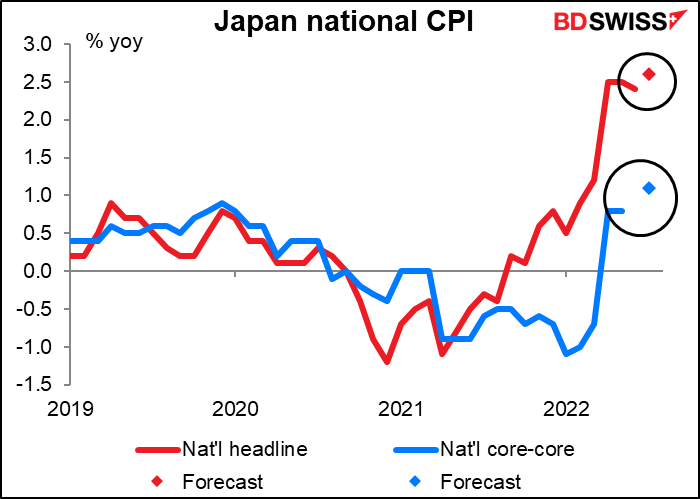

Speaking of incredible comments from leaders, Reuters reports that Japan PM Kishida is going to order his government to come up with ways to cushion the impact of rising energy & food prices on the long-suffering Japanese populace. “I will order additional, seamless steps to be taken focusing on energy and food prices, which make up most of the recent rise in inflation,” Kishida told reporters. With an inflation rate of 2.4% yoy (expected to rise to 2.6% in next week’s announcement – see today’s Weekly Outlook), Japan hardly looks like a country troubled by high inflation.

But PM Kishida is right that Japan’s inflation is concentrated in energy and food, prices that the electorate is keenly aware of because they buy them frequently (whereas abacus lesson prices, which used to be included in the CPI – I don’t know if they still are – are probably not a major source of concern). The national “core-core” CPI, which excludes fresh food and energy, is rising only 1.0% yoy, which shows how much of the inflation is due to those two categories.

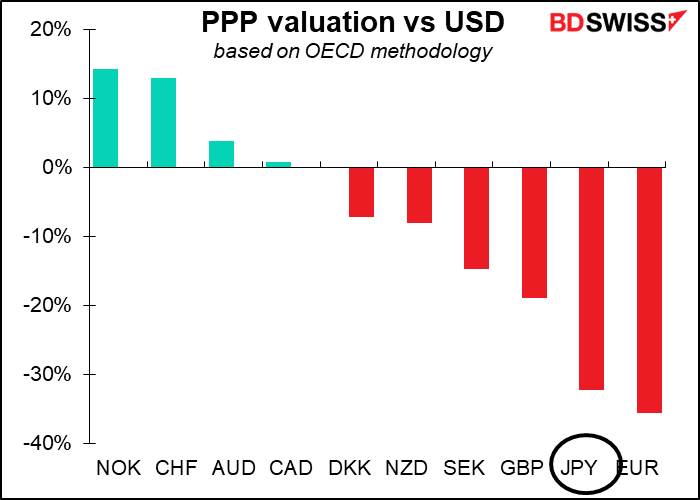

If PM Kishida’s concern signals a change in Japan’s attitude toward inflation, it would be a major change in the foreign exchange market. The idea that Japanese interest rates will be anchored at zero indefinitely is one of the core beliefs of the market, and with good reason. If that starts to change, then JPY – a significantly undervalued currency thanks to its ultra-loose monetary policy – could come in for some rapid revaluation.

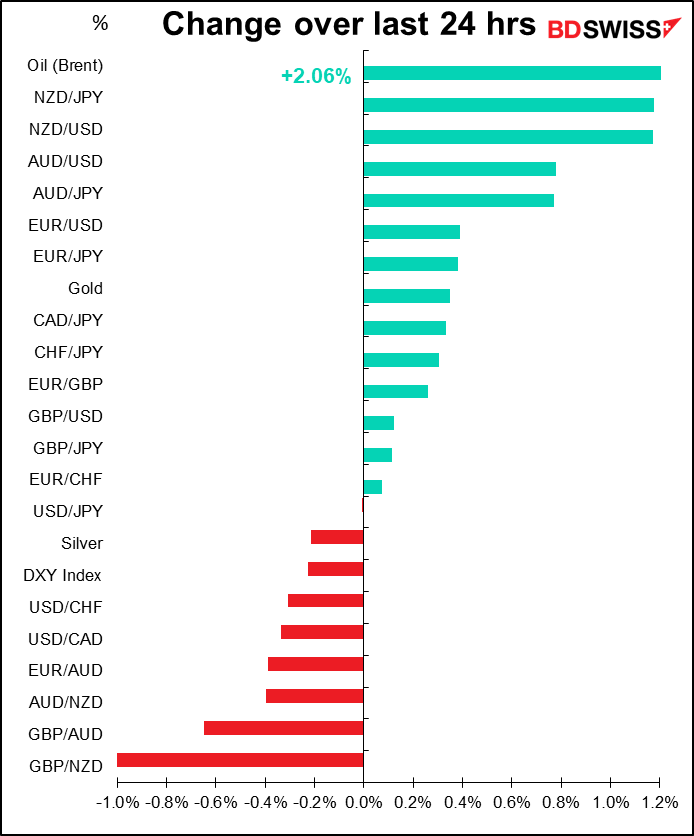

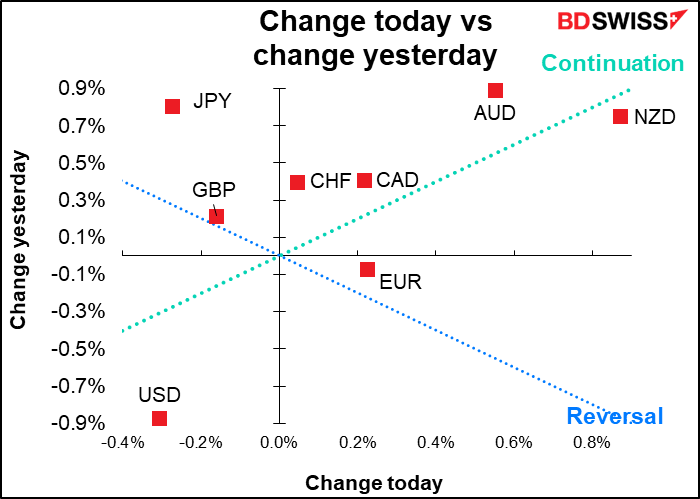

As for today’s FX market action, it’s full of confusing and contradictory moves.

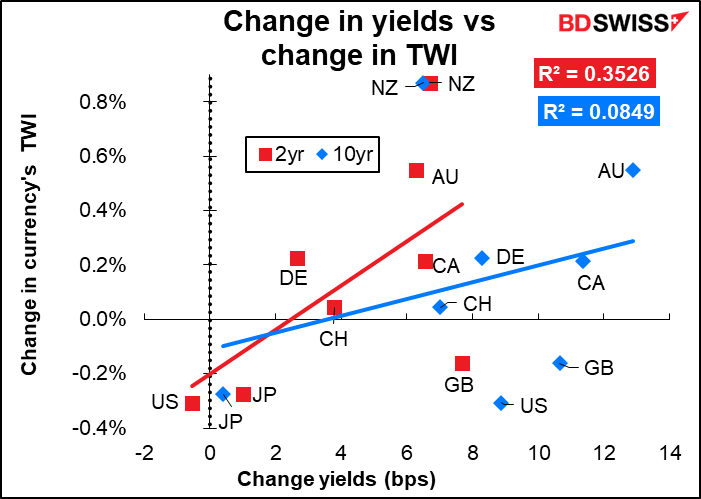

No one seems to have a clue why NZD is the best-performing currency. It didn’t have much to do with interest rates; if anything, NZD was an outlier in that regard.

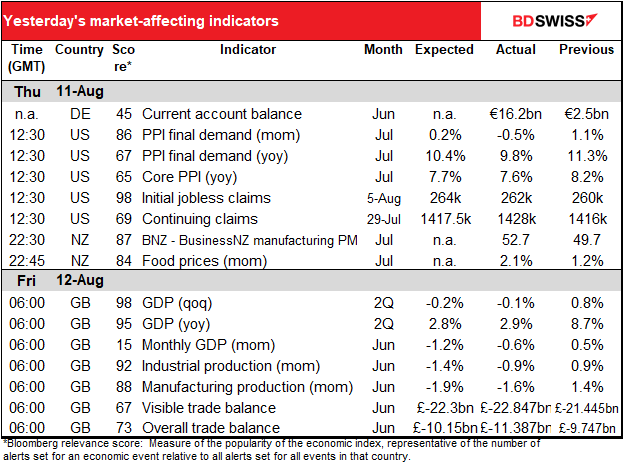

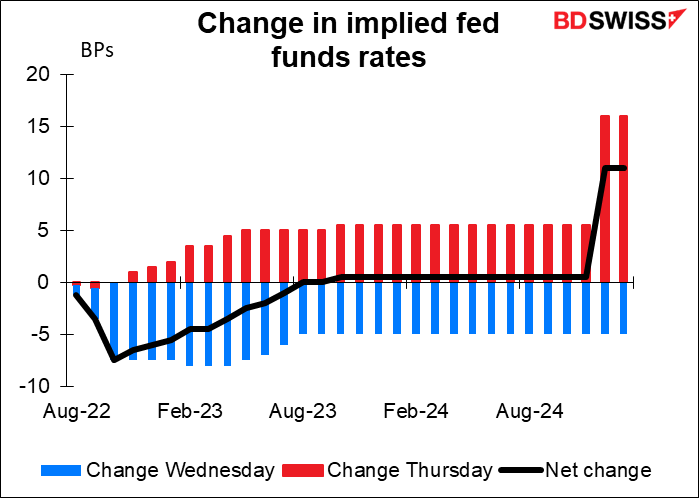

At the same time, the fall in USD also looks strange, given that the market yesterday reversed much of the loosening sentiment that Wednesday’s lower-than-expected US CPI caused. It’s also not clear to me why that happened; the US producer price index (PPI), released yesterday, also came in below expectations (see table above), confirming the idea started by Wednesday’s CPI that perhaps US inflation is peaking.

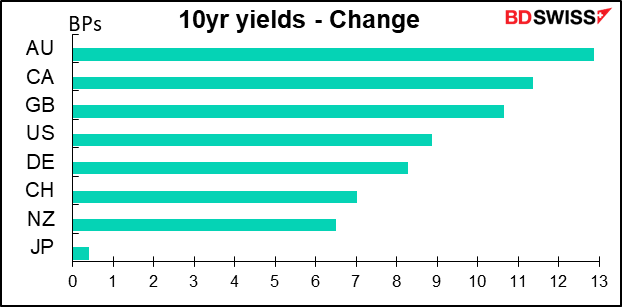

Yet US (and other countries’) bond yields rose. US 10-year yields, at 2.87%, are well above where they were before the CPI came out on Wednesday (2.80%) although 2-year yields are lower (3.21% vs 3.27%). Truly a confusing day that I don’t have a consistent explanation for, nor have I seen one elsewhere.

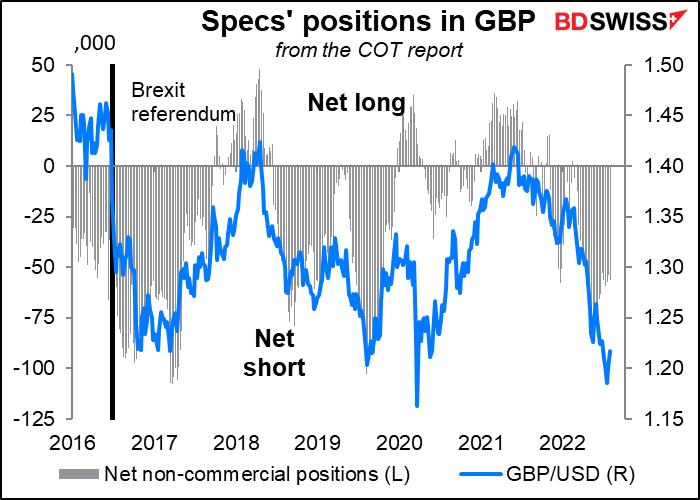

Note please that the UK June and Q2 GDP came in above expectations (see table above). This is offering some support to GBP this morning, which I expect could continue ahead of the weekend as speculators are quite short GBP.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

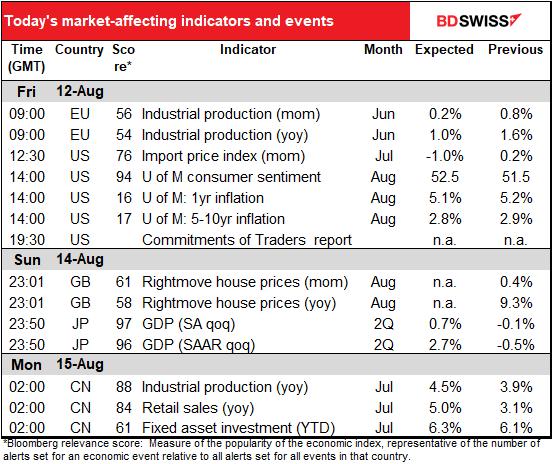

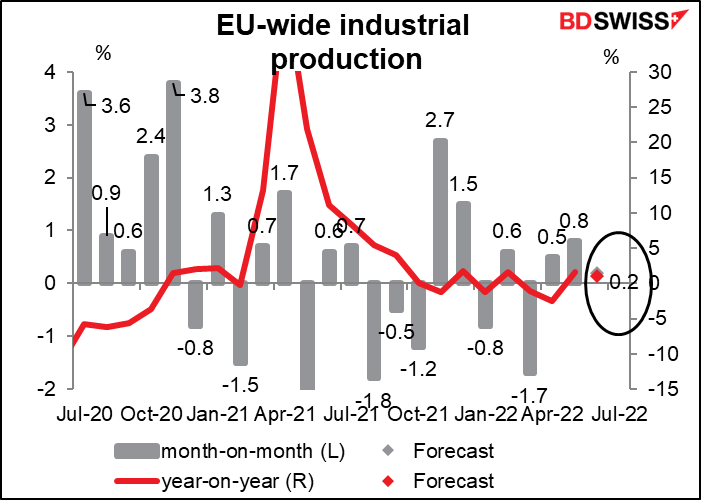

EU industrial production is expected to show only modest growth. (Note that the year-on-year dot is covering over the month-on-month dot so it looks like there’s only one dot.)

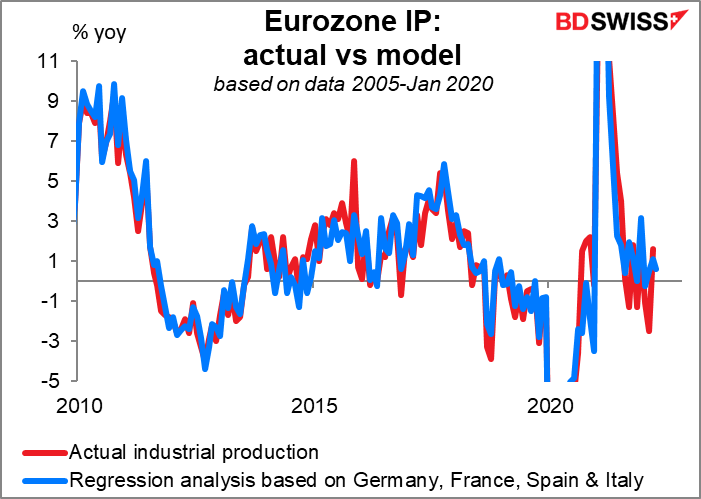

The figure is probably pretty well discounted already, since the data for the four major economies (Germany, France, Italy, and Spain) are already out. Based on the past relationship of those four to the overall EU figure, the headline number should come in at +0.6% yoy, below the consensus estimate. However the model, which is based on the pre-pandemic relationships, isn’t fitting as well now as it used to, so there’s still plenty of room for a surprise.

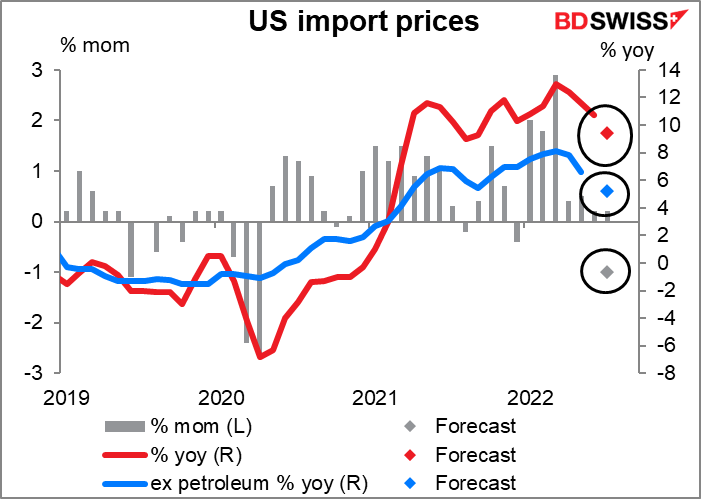

US import prices are expected to fall steeply. Much of that is probably energy prices. But even the figure excluding petroleum is forecast to be -0.1% mom, which translates into 5.2% yoy, down from 5.4% yoy in the previous month.

The decline in import prices excluding petroleum goes along with the decline in China producer prices. That’s of course not where all the imported goods come from, but it’s enough to keep it on track.

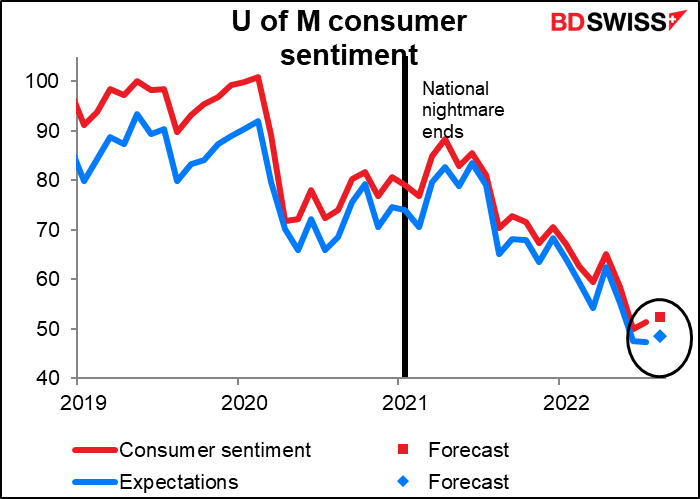

Finally we get the fabled University of Michigan consumer sentiment indices. I have big doubts about these figures, since they’re derived from a survey of some 300 people (the final figure adds another 200 or so for a total of around 500). In any event, sentiment is forecast to tick up a bit, which is good news. The rise in the stock market, the fall in gasoline prices, and the booming labor market should boost people’s outlook a bit, no?

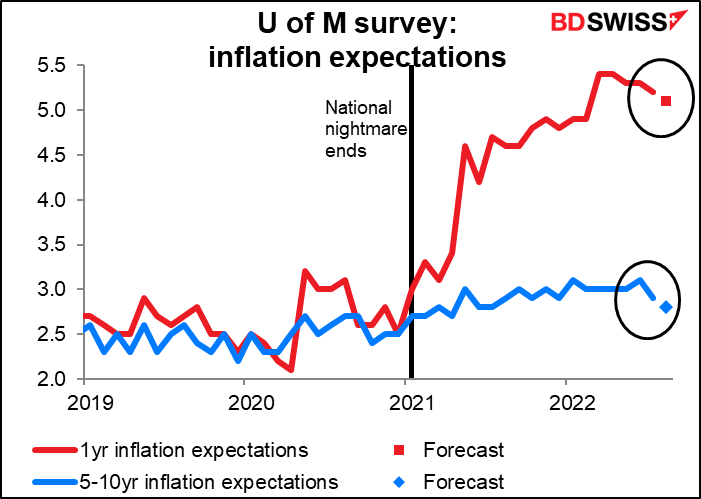

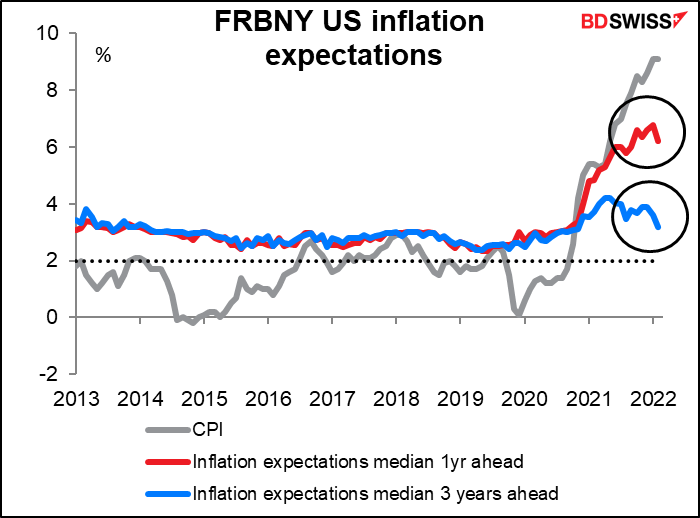

Probably though inflation expectations are more important than consumer sentiment. The minutes of the June meeting of the rate-setting Federal Open Market Committee (FOMC) showed that Committee members specifically referred to the rise in 5-10 year inflation expectations as one of the reasons why they decided to hike by 75 bps instead of the expected 50 bps. “…many participants raised the concern that longer-run inflation expectations could be beginning to drift up to levels inconsistent with the 2 percent objective. These participants noted that, if inflation expectations were to become unanchored, it would be more costly to bring inflation back down to the Committee’s objective.”

However a recent Economic Letter by the San Francisco Fed (“Will Workers Demand Cost-of-Living Adjustments?”) argued that

“year-ahead inflation expectations have a large impact on wage inflation, while long-term inflation expectations have essentially no influence. Given the large increase in short-term inflation expectations in the past year, our results point to an important upside risk to inflation, as workers demand higher wages that businesses could pass on to consumers by raising prices.”

That’s why I expect the Fed to pay more attention to the expected decline in 1-year inflation expectations, which are forecast to drop only slightly to 5.1% yoy from 5.2%. The peak was 5.4% in March and April so it hasn’t come down much. With the Fed’s inflation target at 2%, this is still too high, although headed in the right direction.

The New York Fed’s survey of inflation expectations one year ahead recently fell to 6.22% from 6.78% — also the right direction but also way too high. The Fed isn’t about to give up its fight any time soon even if actual inflation is slowing, as we saw on Wednesday.

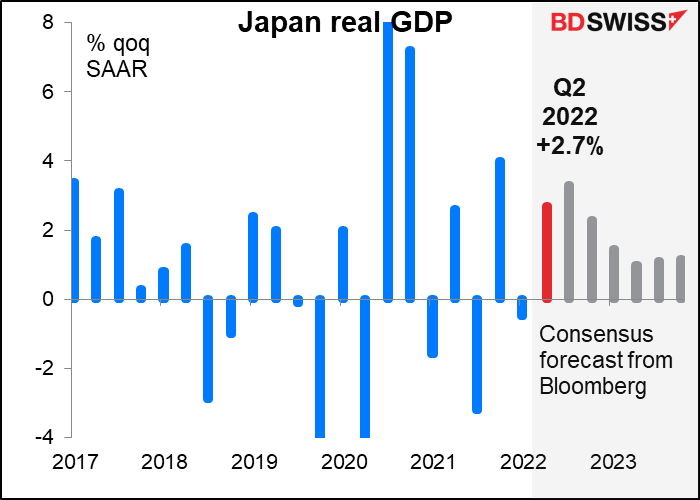

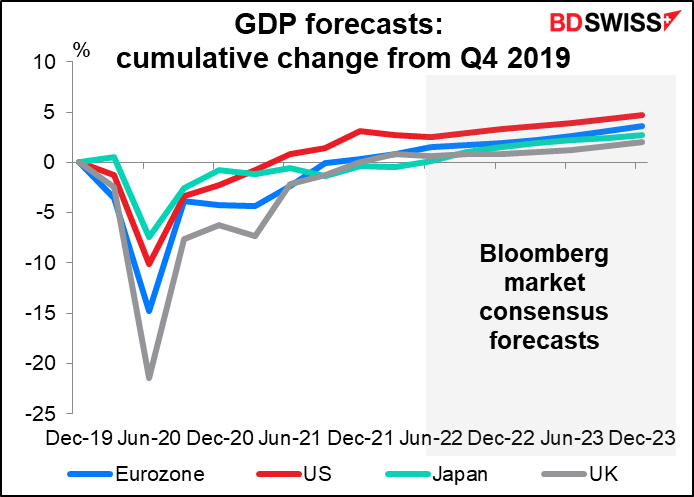

Then first thing Monday morning in Asia, Japan announces its 2Q GDP figure. It’s expected to bounce back after Q1’s small decline.

If this forecast is correct, Japan’s output will finally regain its pre-pandemic level. It’s the last of the four big economies to do so. However, Japan is expected to overtake the UK and be on part with the EU over the next year or so.

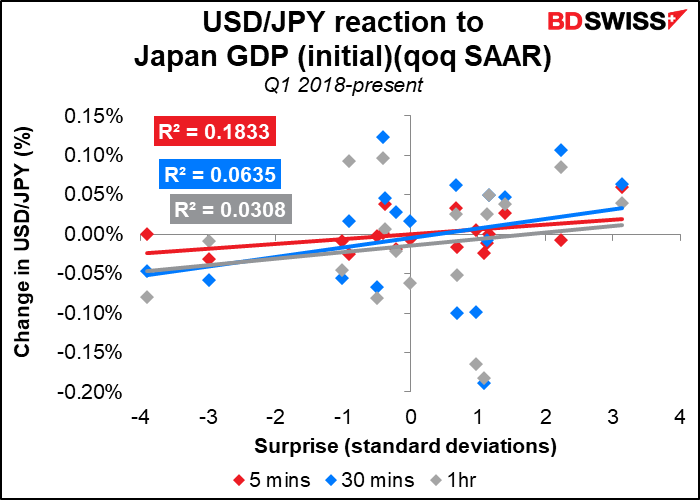

Rising GDP could boost Japan’s stock market a bit, which might actually hurt JPY by causing a “risk-on” mood. As the graph shows, USD/JPY doesn’t have that strong a reaction to the GDP figure, but insofar as it does, the yen tends to weaken (USD/JPY moves higher) when the GDP figure surprises on the upside.

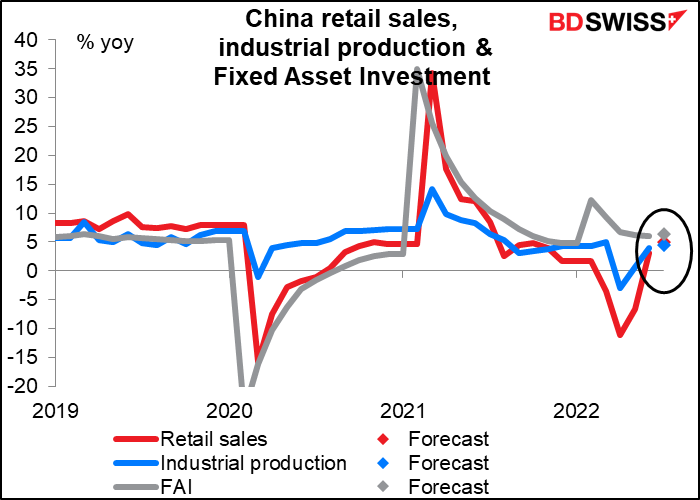

Monday morning also brings three major Chinese indicators: retail sales, industrial production, and fixed asset investment (FAI). They’re all expected to gain as China comes out of its COVID-19 lockdown. That could help the week to start off on a “risk-on” mood, which might be positive for the commodity currencies.